riverside county tax collector auction

The division is located at the Purchasing and Fleet Facility 2980 Washington St Riverside CA 92504. Campos Tax Services Edinburg Tx.

Food Donations Environmental Health Riverside County

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest.

. Access to Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board. The Riverside County Treasurer Tax-Collector will be postponing 25 parcels from this sale to Thursday July 16 2020 beginning at 800 am through July 21 2020 and closing at staggered times. These are all NO RESERVE auctions.

Riverside County CA is offering 827 tax defaulted properties for online auction. The combined office is led by Jon Christensen a countywide publicly elected official serving the fourth largest county in. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Riverside County CA at tax lien auctions or online distressed asset sales.

The Assessor determines a value for all taxable property and applies all legal exemptions and exclusions. Shutterstock RIVERSIDE COUNTY CA More than 800 tax-defaulted properties throughout. The Assessor locates all taxable property in Riverside County identifies the owners and describes the property.

Posted Tue Apr 28 2020 at 201 pm PT. The Assessors primary responsibility is to value taxable property. The Surplus Division manages the disposal of County surplus items such as office equipment by redistributing to other County departments or agencies.

The auction is conducted by the county tax collector and the property is sold to the highest bidder. Search our database of Riverside County Property Auctions for free. The purpose of a Secured tax sale is to return tax defaulted property back to the tax roll collect unpaid taxes and convey title to the purchaser.

Inventory of Parcels Subject to Power of Sale - July 1 2016. The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures. IRS DEA and police auctions.

Properties become subject to the County Tax Collectors power to sell because of a default in the payment of property taxes for five or more years. 951 955-6200 Live Agents from 8 am. Welcome to the County of Riverside Assessor Online Services.

Contact the Riverside County Tax Collectors Office to verify the time and location of the Riverside County tax sale. Each of the 25 parcels will be noted as Postponed in the Auction Title. Office Hours Locations Phone.

Public auctions are the most common way of selling tax-defaulted property. Reassessment The rate or value of a property when a change in ownership or completion of new construction occurs. Welcome to the Riverside County Property Tax Portal.

In accordance with California law the Riverside County Tax Collector will commence the public auction of properties for which the taxes interest and fees have not been paid and continues from day to day until each property is sold to satisfy the taxes interest costs and charges. The Assessor must complete. If you have further questions please contact our office at 951955-3900 or e-mail your questions to.

Speak Victory Over Your Life Scripture. An auction held pursuant to the California Revenue and Taxation Code Section 3691 in which the Department of Treasurer and Tax Collector auctions and sells tax-defaulted properties in its possession. Riverside County Assessor-County Clerk-Recorder Office Hours Locations Phone.

Riverside County Assessor-County Clerk-Recorder. Sales Tax Reno Nv 2021. The Riverside County Treasurer-Tax Collector is responsible for the billing and collection of property taxes and for the receiving processing investing and most importantly safeguarding of public funds as mandated by the laws of the state of California.

It is our hope that this directory will assist in locating the site. Mandarin Chinese Restaurant Lahore. Properties become subject to the County Tax Collectors power to sell because of a default in the payment of property taxes for five.

All Foreclosure Bank Owned Short Sales Event Calendar. Riverside County CA currently has 3207 tax liens available as of March 24. Riverside County Offers Tax-Defaulted Properties in Online-Only Auction.

Riverside County Tax Collector Auction. The division also facilitates surplus bids through the use of third party auction companies. Sweet Life Quotes Images.

Ad Gold jewelry coins cars properties. The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments for the county school. Many assessment records of real and personal property are available for sale.

A 27-acre parcel in Winchester was originally valued at roughly. Our Client Services Department will stay open until 800 PM ET 500 PM PT on Monday May 17th Bids start as low as 10000. All other parcels will be offered for sale as indicated above.

The auction is scheduled to run from Thursday morning to May 5. Secured - The purpose of a Secured tax sale is to return tax defaulted property back to the tax roll collect unpaid taxes and convey title to the purchaser. Pursuant to California Revenue and Taxation Code RTC section 37005 the county tax collectors are required to notify the State Controllers Office not less than 45 days nor more than 120 days.

In accordance with California law the Riverside County Tax Collector will commence the public auction of properties for which the taxes interest and fees have not been paid and continues from day to day until each property is sold to satisfy the taxes. 951 955-6200 Live Agents from 8 am - 5 pm M-F Click Here to Contact Us. Auctions are conducted to liquidate personal property from decedents estates which the Public Administrator is administering.

Tax Sale Bidding Process. Find and bid on Residential Real Estate in Riverside County CA. The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce taxpayers to the organizations that handle the property tax process in Riverside County.

Change of Mailing Address.

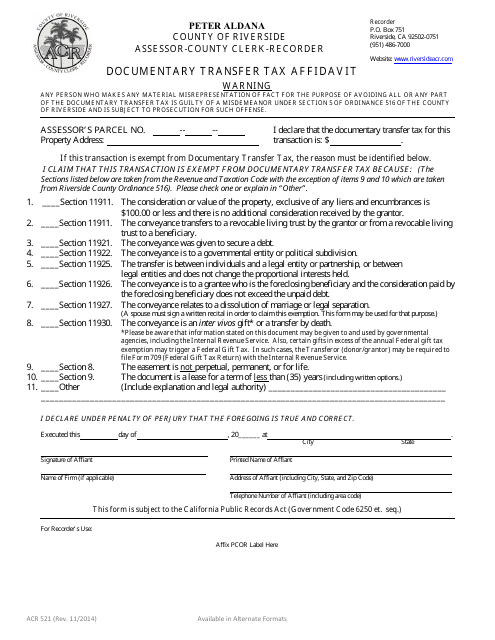

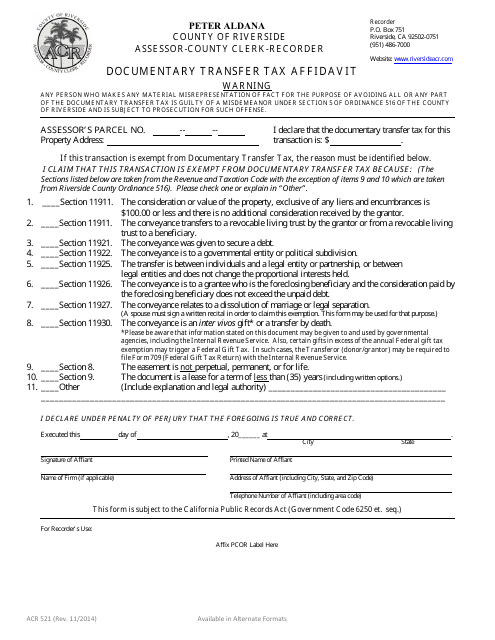

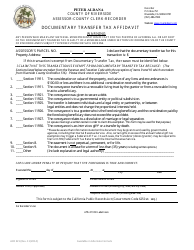

Form Acr521 Download Fillable Pdf Or Fill Online Documentary Transfer Tax Affidavit County Of Riverside California Templateroller

Meet Your Treasurer Tax Collector

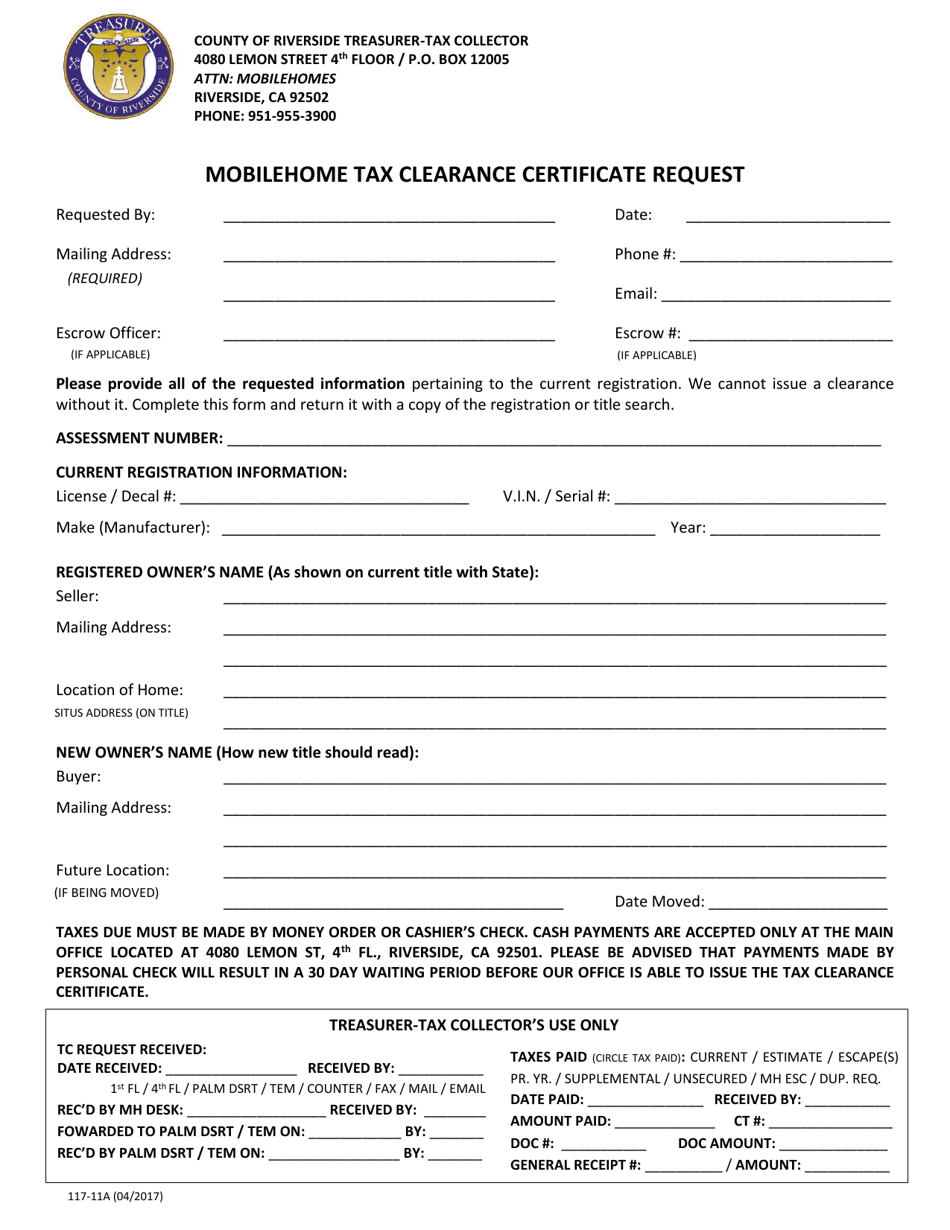

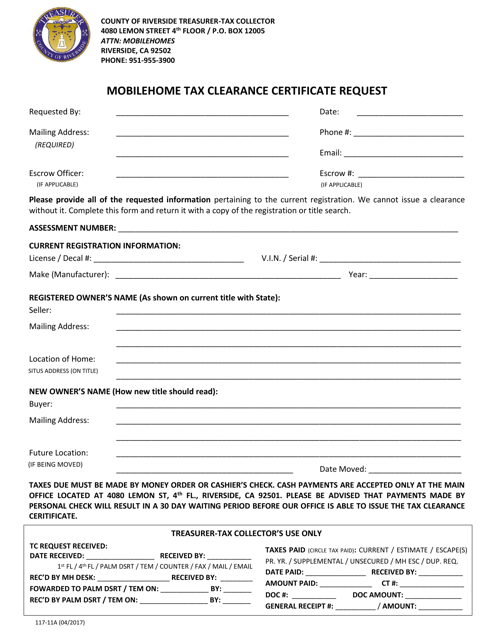

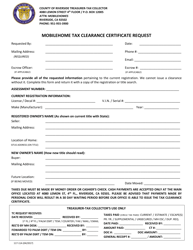

Form 117 11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

City Of Arts Innovation Riverside Police Department Police Patches Riverside Riverside County

Access Denied Riverside Spruce Outdoor Decor

Food Handler Certification Environmental Health Riverside County

Form Acr521 Download Fillable Pdf Or Fill Online Documentary Transfer Tax Affidavit County Of Riverside California Templateroller

What Is This Extra Tax Bill I Got Supplemental Tax Bills Explained Youtube

Signed Love Cjb Her Initials Excellent Condition Ebay Riverside California California Mission Inn

Riverside County California Fed Loan Information Fhlc

Region Let The Fun Begin Hartford Courant

Form 117 11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

Form Acr521 Download Fillable Pdf Or Fill Online Documentary Transfer Tax Affidavit County Of Riverside California Templateroller

Riverside County Planning Department Frequently Asked Questions

Access Denied Oceanside Property Records Coast

Form 117 11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

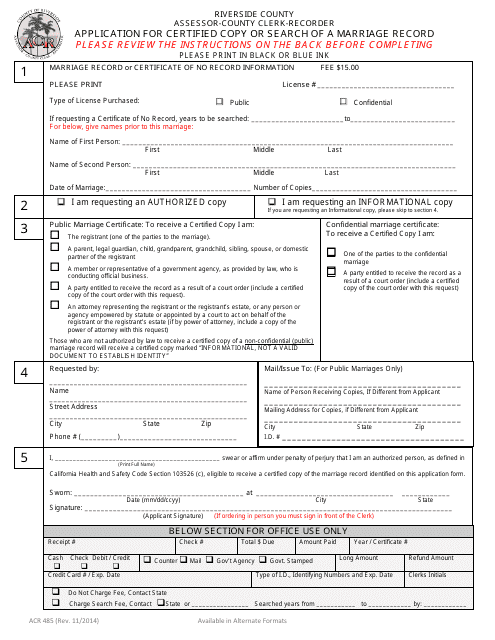

Form Acr485 Download Fillable Pdf Or Fill Online Application For Certified Copy Or Search Of A Marriage Record Riverside County California Templateroller